Make / Model Search

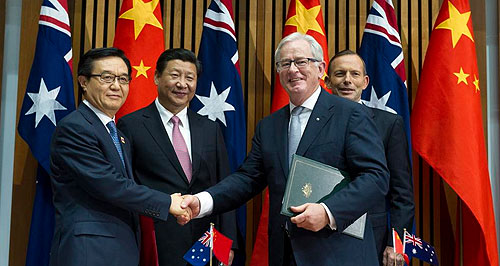

News - General News - GovernmentFTA with China could damage local parts sector: FAPMTariff reduction: Australia’s largest importer and distributor of Chinese vehicles said the FTA with China won’t significantly reduce prices on cars. Parts industry could suffer, cars may not be much cheaper, in trade deal with China18 Nov 2014 AUSTRALIA’S landmark free trade agreement with China looks set to benefit consumers and the motor vehicle insurance industry, but the automotive parts sector has warned that it could have a damaging effect on component manufacturers. The Federation of Automotive Products Manufacturers (FAPM) has expressed concern that the China-Australia Free Trade Agreement (ChAFTA) could bring an influx of cheaper Chinese components, leading to damaging consequences for domestic producers already suffering from the forthcoming closure of Australia’s three remaining car manufacturers – Ford in 2016 and Holden and Toyota a year later. While the federal government has suggested consumers will benefit from cheaper cars, Australia’s largest importer and distributor of Chinese vehicles, Ateco Automotive, has also told GoAuto that any reduction in price will be almost negligible due to existing small tariffs and the fact that cars are already being priced as low as possible. That is despite the Federal Chamber of Automotive Industries (FCAI) trumpeting the ChAFTA announcement as a win for consumers, saying the deal will bring in more cars at lower prices. The Insurance Council of Australia has also welcomed the agreement, which will allow Australian insurance providers access to China’s third-party motor vehicle insurance market. FAPM chief executive Richard Reilly told GoAuto this week that a free trade agreement needed to be fair on the local parts industry, especially with manufacturing ending within three years. “FAPM’s position on free trade agreements is that they must be equitable and allow Australian component producers an opportunity to enhance their businesses – and in the current climate, with vehicle manufacturers having announced their intention to cease vehicle manufacturing by the end of 2017, give our component producers the best chance to restructure their businesses,” he said. A release from the department of foreign affairs and trade states there will be a reduction of tariffs on automotive parts including the elimination of a 10 per cent tariff on car engines exported to China – a market worth more than $102 million, according to the government. Mr Reilly said the agreement was not likely to spur exports to China, due to an established market in place there, while imports flooding into Australia will put pressure on local parts-makers. “The FTA is unlikely to induce suppliers to commence exports to China, given the growing maturity of the Chinese market with the more likely business case being the establishment of joint-venture companies in China for production of components in China,” he said. “Conversely, the ChAFTA will make Chinese components more competitive in the Australian market and will most likely see an increase in imports into Australia, given the labour cost differential between the two countries. “This could have a negative effect on domestic producers, who are currently working to sustain their businesses in a period of reduced local vehicle production volume.” According to Mr Reilly, Australian parts producers must pursue any global business opportunities offered by the agreement. “We certainly expect there will be an Australian component sector post-2017 when the vehicle manufacturers cease manufacturing locally,” he said. “Our hope is that the component manufacturers that sustain their businesses post-2017 will be looking internationally to enter global supply chains to take whatever advantage there is in agreements like the ChAFTA.” While those in the component industry may face an uncertain future, the government has said consumers will benefit from cheaper priced cars. But according to Ateco Automotive – the Australian importer and distributor of Chinese brands such as Chery, Foton and Great Wall – the price cuts will be small, at best. Ateco Automotive Asian brands public affairs consultant Daniel Cotterill said this is because tariffs are already low and that currency fluctuations were more likely to impact prices. “Any reduction in tariffs on Chinese vehicles via this new free trade agreement will be welcomed by importers,” he said. “But given the comparatively low rate of tariff and the basis on which it is charged there won’t be a really significant impact in terms of competitive retail pricing when the cut is implemented in two to four years’ time. “The single most important factor in competitive pricing that affects Chinese cars that we pay for in US dollars is the Australian-US dollar exchange rate. That was steady at around $1.05 for a fair while last year and is about 87 cents today, a 17 per cent change that puts the benefit of a five per cent tariff reduction into context. “Similarly, the devaluation of Japan’s currency over the past couple of years has made an enormous impact on the ability of Japanese vehicles importers to make their retail prices more competitive.” FCAI chief executive Tony Weber said that while he is looking forward to seeing further details of the agreement, it will mean more cars from China at cheaper prices. “Combined, the Japan-Australia Economic Partnership Agreement, the Korea-Australia FTA, Malaysia-Australia FTA, Thailand-Australia FTA and Australia-United States FTA, when all are fully in effect, will mean that two-thirds of all motor vehicles entering Australia will be duty free,” he said. “The FTA with China will increase this further, meaning more motor vehicles will land in Australia at a lower price than they do currently. “Australia is already one of the world’s most competitive new-car markets. These FTAs will only increase competition in Australia. This is good news for Australian consumers.” The biggest winners in the wider automotive industry may be Australian insurance companies which will be allowed access to China’s third party liability motor vehicle insurance market. Insurance Council of Australia general manager of communications and media relations Campbell Fuller said the news was positive but it would be up to the individual companies to make inroads into China. “The Insurance Council of Australia welcomes the lowering of trade barriers for the expansion of financial services in China, in particular providing greater access for Australian insurers in China’s third party insurance market,” he said. “However, any decision regarding doing business in China would be up to individual insurers.” The prime minister announced yesterday that negotiations for ChAFTA were complete with the Declaration of Intent to be signed that afternoon. Australia has free trade agreements with New Zealand, Chile, the US, Malaysia, Singapore and Thailand. Currently an FTA is signed with South Korea while another is now in the early stages of negotiation with India.  Read more |

Click to shareGeneral News articlesResearch General News Motor industry news |

Facebook Twitter Instagram