Make / Model Search

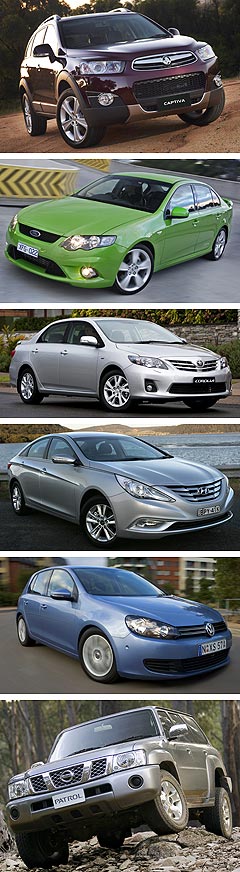

News - VFACTS - Sales 2011VFACTS: Holden on top as Toyota comes up shortSmall victory: The strong monthly sales performance of the Cruze helped Holden take out the overall top spot in June, beating out supply-ravaged foe Toyota. Japanese quake shortages strangle Toyota sales as Holden grabs a rare win3 Jun 2011 HOLDEN outsold Toyota last month to take the monthly sales crown for the first time since March 2005 as stocks of rival Japanese-brand vehicles dried up in the wake of the Japanese earthquake and tsunami. Long-time market leader Toyota’s May sales dropped 38.1 per cent compared with the same month last year, to 11,044 vehicles – 71 vehicles short of Holden’s 11,115 sales, official VFACTS figures show. But the win might be short-lived, with Toyota saying its factories in Japan, Thailand and Australia are quickly cranking back up to normal levels as the parts shortages caused by the Japanese disaster in March are overcome. Toyota Australia senior executive director sales and marketing David Buttner said the number of vehicles arriving this month from Toyota plants would be almost double the May level, with priority being given to customers who had already placed orders. "In July, we will receive almost the full quota of cars we ordered well before Japan's natural disasters occurred," he said. "For the rest of the year, our business will basically be back to normal, thanks to a faster-than-expected pick-up in production."  From top: Holden Captiva 7, Ford Falcon, Toyota Corolla, Hyundai i45, Volkswagen Golf, Nissan Patrol. From top: Holden Captiva 7, Ford Falcon, Toyota Corolla, Hyundai i45, Volkswagen Golf, Nissan Patrol.Holden resisted the temptation to gloat over its win, acknowledging the “difficult circumstances” of its rivals while at the same time highlighting the success of its own products, including the top-selling small car, the Series II Cruze. Toyota’s fellow Japanese brands were in the same stock shortage boat, helping to drag down the entire Australian new-vehicle market by 13.2 per cent, to 77,406 vehicles – the worst May result since the global financial crisis in 2009 when just 75,650 vehicles found homes. Double-digit sales falls were recorded by Mazda (down 14.2 per cent), Nissan (down 12.4 per cent), Mitsubishi (down 18.3 per cent), Subaru (down 32 per cent) and Honda (down 34.4 per cent), while companies such as Hyundai and Volkswagen made major gains – up 16.7 per cent and 8.8 per cent respectively. For the first time intwo years, Kia made it into the top 10 with May sales of 2353 units, up 15.7 per cent, knocking Honda down to 11th. The Toyota result was the company’s lowest monthly tally since January 2002, and its lowest May volume for more than a decade. Unaffected by the Japanese parts shortages, Holden’s May sales held up better than many, declining just 2.3 per cent. The Holden Cruze – which recently went into local production at Holden’s Elizabeth plant – took the small-car crown for the first time, its 2914 sales accounting for the Mazda3 (2797), Hyundai i30 (2479), and VW Golf (1864). For the first time in memory, the Toyota Corolla (1454) finished fifth – a victim of the stock drought. Holden’s Commodore was again the top selling vehicle in the land, with 3505 sales, outselling the Toyota HiLux (3162) and Holden’s other winner, the Cruze (2914). Commodore took a massive 60 per cent chunk of the large-car segment as Ford’s Falcon continued to flounder, with the big Ford scoring just 1331 sales for May – a drop of 59.1 per cent. That, and a 54.5 per cent plummet in sales of Ford’s other locally made vehicle, the Territory (480 units), contributed to a 24.3 per cent fall in Blue Oval sales, to 6830, placing Ford fourth behind Holden, Toyota and Hyundai. It was the third month this year that Ford has dipped below 7000 units, with a lot of current volume being generated by discounted run-out models such as Focus and Ranger. Ford’s market share so far this year has slipped to 9.0 per cent – just 0.2 percentage points ahead of Mazda (8.8 per cent) and 0.4 per cent in front of Hyundai (8.6 per cent). The other two Australian manufacturers have also lost ground this year, with Holden’s share drifting from 13 per cent at this time last year to 12.4 per cent, and Toyota’s sliding from 20.4 per cent to 18.1 per cent. Ford is counting on the arrival in showrooms this year of several new models, including the new Focus and Ranger, as well as the recently released facelifted Territory. Leading Korean brand Hyundai continues to grow both volume and share, swimming against the tide to record 16.7 per cent sales growth in May, to 7444 units. Its ix35 (1035) was the best-selling compact SUV on the market in May, growing 67.2 per cent to pip the Subaru Forester (1004), while Hyundai’s Sonata replacement, the i45, and i30 light car came on strong. Holden’s double-barrelled Captiva range – the 5 and 7 – combined to take the top position in SUV sales, with the ‘7’ dominant in the medium segment, while Toyota’s HiLux retained light-truck leadership. In medium cars, Toyota’s ageing Camry still had enough in the tank to take victory, with 1499 units, despite a 23.8 per cent fall due to the factory go-slow at Altona due to parts scarcity. All passenger car segments took a hit in May, with the biggest falls being record by large cars (down 32 per cent) and sports cars (down 21.6 per cent). Even the compact SUV segment, which has helped to drive market growth in recent years, dropped 7.3 per cent, but the biggest plunge of all segments came in large SUVs, where the Japanese disaster wreaked 43 per cent-drop havoc due to scarcity of Toyota LandCruisers and Nissan Patrols. Light commercial vehicles – dominated by Thai-built one-tonners and Aussie utes – fared better, falling 6.4 per cent for the month. Federal Chamber of Automotive Industries (FCAI) chief executive Andrew McKellar said the underlying trend in new vehicle sales had been softer over the past few months, which he said was “consistent with a range of other demand indicators”. “It is also clear that a number of brands have experienced disruption in the supply of some vehicle models and components, as a consequence of the Japanese tsunami,” he said. “More recent reports indicate that these challenges are now being addressed more quickly than originally expected and we are hopeful that supply constraints will improve over coming months.”

Read more |

Click to shareVFACTS articlesResearch VFACTS Motor industry news |

||||||||||||||||||||||||||||||||||||||||||||||||

Facebook Twitter Instagram