Make / Model Search

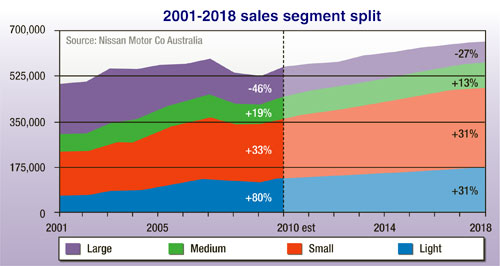

News - Nissan - MicraNissan to max MicraOn the up: Nissan is pinning its market share ambitions on the success of its new Micra. Australian light-car segment to boom as Nissan eyes a top three share with Micra22 Nov 2010 NISSAN’S audacious quest to be Australia’s top vehicle importer within little more than two years starts with the fourth-generation Micra. Launched last week ahead of its official release on December 1, the K13 Micra is expected to be a top-three player in a booming light-car segment that Nissan has forecast will grow by almost a third over the next eight years. The all-new Thai-built light-car will be followed in 2012 by the larger Tiida Replacement (TR), which Nissan says will rival the top-selling Mazda3 and Toyota’s Corolla in a small-car class that the company also expects will increase by 31 per cent between 2010 and 2018, maintaining its position as the nation’s biggest sales segment.  From top: Nissan Micra, Nissan Global Sedan sketch, Nissan Navara. From top: Nissan Micra, Nissan Global Sedan sketch, Nissan Navara.However, Nissan describes sustained growth in the light-car segment, which grew by 80 per cent in the last decade and attracts a high 72 per cent private buyer profile, as the “second coming” of Australia’s smallest vehicle size category. While the medium segment is forecast to expand by just 13 per cent by 2018 and large cars are expected to further decline by 27 per cent – on top of a 46 per cent plunge over the last 10 years – Nissan says light cars will continue to comprise the second-largest passenger car market. As such, Nissan Australia CEO Dan Thompson says the K13 Micra is the single most important product in his company’s well-publicised mid-term business plan, GT2012, in which Nissan hopes to claim a 10 per cent market share to become Australia’s number one imported vehicle brand by the conclusion of its Japanese fiscal year on March 31, 2013. To do so, seventh-placed Nissan must eclipse Mitsubishi (which currently holds a 6.1 per cent share), Hyundai (which now holds 7.9 per cent of the market) and leading importer Mazda (which has 8.3 per cent and plans for 10 per cent – and 100,000 sales – by 2014). Nissan, which (like Hyundai) wants Mazda’s fourth-place ranking behind local manufacturers Toyota, Holden and Ford, concedes it is coming off a relatively low base of 6.0 per cent, but says it is well on the way to achieving its 2010 target of 65,000 sales and a 6.5 per cent share. Nissan sales declined by 10.7 per cent from 69,200 to 52,900 in 2009, but it has almost reached that after only 10 months of this year, representing sales growth of 20.8 per cent – more than all of its mainstream rivals except Hyundai, Volkswagen, Suzuki and Kia. To play its role in the GT2012 plan, however, the Micra must make a quantum leap over its predecessor by attracting 1500 sales per month when supplies ramp up at the Thailand factory where it is built, equating to 18,000 annual sales – almost four times as many sales its predecessor attracted. Since going on sale here in October 2007, the single-spec K12 Micra has averaged about 400 sales per month for an average annual total of less than 5000. Last year, Micra was a lowly top-ten light-car player with a 4.5 per cent segment share and just over 5100 sales. In run-out mode this year, after peaking at 1000 sales in June, Micra is selling at the rate of about 600 a month and has attracted more than 6800 sales to October, notching up sales growth faster than any model in the light-car segment. Micra now accounts for 6.1 per cent of the light-car segment, representing a 58.3 per cent sales increase so far this year for a total of more than 20,000 in three years. Aiding Nissan’s cause alongside the outgoing Micra was the Dualis (up 267.7 per cent), Navara 4x4 (up 20.5 per cent) and X-Trail (up 24.2 per cent), giving Nissan a 2010 market share growth that is second only to Hyundai. Should Micra reach 18,000 annual sales, it would be vying with the Navara to be Nissan’s top-selling model in Australia and would be a top-three player in the booming light-car segment – without counting the Micra-based light sedan that will join it on sale here in just over 12 months. To do so, Micra would have to overhaul light-car staples like the Honda Jazz, Kia Rio, Ford Fiesta, Suzuki Swift, Holden Barina and Mazda2, all of which will be renewed within the next 18 months, before vying with the top-selling Toyota Yaris and Hyundai Getz. While Yaris will be replaced inside 12 months, Getz stocks will be exhausted by mid-2011, when the Korean brand’s new i20 will be bolstered by the all-new Accent sedan and, possibly, the all-new i10 in the light-car class. On paper, Nissan appears well-armed to achieve far greater sales success with the expanded K13 range, which, apart from more mainstream styling, two engine and three equipment variants, offers a manual transmission for the first time in an Australian Micra for 15 years. While the previous Micra came from Japan, Thailand will supply the K13 for both Australia and Japan, with China, India and Mexico also set to produce the new model. Ahead of its arrival, Nissan says it undertook a “massive” investment to prepare its dealer network for the new Micra, which will be sold in an unprecedented 160-plus nations globally. Globally, Nissan eventually expects to sell more than one million Micras per annum. “These are really, really big numbers,” said Kazuhiro Doi, Nissan’s chief product specialist for the V-platform on which the Micra is based. Next month’s Micra hatch will be joined in Nissan’s quest for import dominance by the X-Trail 2WD (in January 2011) and, in 2012, the Micra-based sedan, the redesigned Patrol, all-new Leaf EV, and sedan and hatch versions of the Tiida small-car replacement.  Read more |

Click to shareNissan articlesResearch Nissan Motor industry news |

Facebook Twitter Instagram