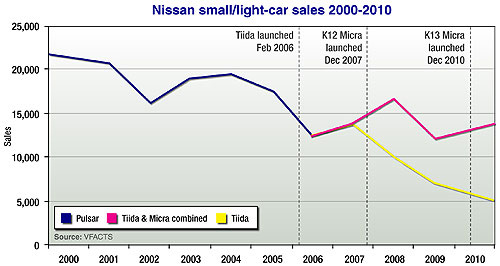

News - Market Insight - Market Insight 2011Market Insight: Nissan closes in on 10 per cent dreamSlow-seller: Nissan's Tiida has failed to sell in the same numbers as the venerable Pulsar it replaced. Nissan set for record year but market share ambitions rely on new model popularity18 Apr 2011 NISSAN made a return to the top five in Australia’s sales charts last month, grasping an 8.3 per cent market share for March in the process. Its overall market share for the first quarter of this year is 7.3 per cent, riding on the back of a 19.3 per cent sales surge year to date in a market that is down 1.3 per cent. The Japanese car-maker claims it gained more Australian market share than any other brand last month and that, for the Japanese financial year that ended on March 31, its rising sales accounted for 18 per cent of the local industry’s volume growth. Nissan’s market share grab in 2011 has been assisted by slow sales from the Australian market’s two biggest players – Toyota and Holden – which are down 7.3 per cent and 11.8 per cent respectively YTD. While these numbers are no doubt great news for the Japanese brand, it still has a way to go if it is to achieve its goal of seizing a 10 per cent market share and becoming Australia’s top full-line importer by the end of its 2012-2013 financial year. In the meantime, Nissan Australia managing director and CEO Dan Thompson has set his sights on a minimum seven per cent market share for the next 12 months – exceeding the company’s record as a full-line importer of 6.7 per cent in 2004.  From top: Nissan Navara, Nissan Pulsar, Nissan Sunny. From top: Nissan Navara, Nissan Pulsar, Nissan Sunny.Even Japan’s devastating earthquake and tsunami of March 11, which has interrupted the supply of vehicles and parts, have not dampened Nissan’s spirits. A Nissan Australia spokesperson told GoAuto that its spread of vehicle sourcing from Japan, Thailand and the UK, along with its levels of existing landed and in-transit stock, place it in a “much better position” than most of its competitors. The brand’s sales are presently propped up by the runaway success of the Navara one-tonne ute, which last month accounted for a third of volume. The Dualis and X-Trail SUVs contributed almost another third while the fourth top-seller was the recently-revised and bargain-priced Micra light car. Although Nissan executives could be losing sleep over the brand’s reliance on the popularity of a commercial vehicle, new models are on the way in the form of a Micra-based sedan, luxurious new Patrol and, crucially, a replacement for the slow-selling Tiida small car – which is tipped to revive the Pulsar nameplate. Despite a saucy multi-million-dollar marketing campaign starring Sex and the City actress Kim Cattrall, technical superiority over its predecessor and a more affordable price, the Tiida never captured the imagination of Australian new-car buyers in the same way as its Pulsar-badged predecessor. Maybe the Tiida’s appeal was reduced by its unusual name or its top-hat styling that aped, but in an altogether less confident way, that of the related and boldly-designed Renault Megane. It is more likely that the oddly-named, ungainly Tiida that straddled the light and small-car segments simply lacked showroom appeal compared with its Holden Astra, Ford Focus and Mazda3 rivals. Nissan sold more than 20,000 Pulsars per year at the beginning of the century and even its lowest post-millennium sales figure (16,258 in 2002) was never matched by the Tiida, which achieved a peak of 13,756 units in 2007 before declining rapidly to just 5491 sales last year. The reappearance of the Micra in Australia in late 2007 helped Nissan to stabilise the slide in its small/light segment sales, but even with the Micra included – as shown on the graph – it took two models and a peak year for Nissan small/light-car sales to beat the Pulsar’s lowest result, and even then by just 395 units. The Tiida’s slide has continued this year, with Q1 sales of just 1092 representing a further 46.4 per cent decline YTD compared with the same period in 2010. Were Nissan to launch a small car contender as successful as the Pulsar while maintaining the momentum it is enjoying with its current crop of models, it could add another thousand sales per month to its tally, threatening the market share of Mazda and Ford – and their positions in the sales charts. In March last year, Nissan confirmed to GoAuto its plans to replace the Tiida in 2012 with a car that will bring advancements in design and engineering, sit more comfortably in the small-car segment and, as Mr Thompson put it, promises to be a “great leap forward” that “couldn’t come soon enough”. Another thing that could reassure Nissan’s marketing department and rebuild interest among potential customers will be the fact that Nissan headquarters in Japan has given its Australian operation permission to step away from the Tiida nameplate – paving the way for a reborn Pulsar. Nissan also sees volume potential in the light-sized sedan market, into which it will enter with a Micra-based competitor next year, powered by a 1.5-litre four-cylinder petrol engine mated to a CVT automatic. The third new Nissan for next year, the Patrol, is unlikely to be a volume-seller thanks to its dramatic move upmarket (the premium variant is expected to exceed $100,000) compared with the comparatively tough and utilitarian existing model, which will live on alongside the new model in Australia. Things are looking good for Nissan, but with local production of Holden’s Cruze (and a hatch in the pipeline), a new Focus on the way later this year, highly-efficient new Mazdas on the horizon and the ever-present threat from South Korean duo Hyundai and Kia – the ambitious Japanese brand will have a fight on its hands.  Read more |

Click to shareMarket Insight articlesResearch Market Insight Motor industry news |

Facebook Twitter Instagram