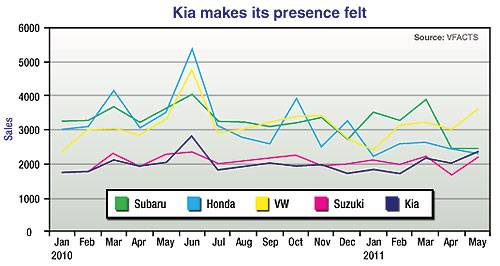

News - Market Insight - Market Insight 2011Market Insight: Kia aims for regular top-10 sales spotSales driver: Kia sales aspirations in Australia rely heavily on the new-generation Rio, which launches here in five-door form in August. Overseas demand curbs Kia’s growth in Australia, but Korean brand has big ambitions24 Jun 2011 By TERRY MARTIN KIA has made it clear that it believes it should be a permanent member of the ‘Top 10’ club after storming into the Australian new-vehicle top-10 sales chart last month for the first time in more than two years. Although Kia Motors Australia acknowledges that its May result of 2353 new registrations – enough to pass Suzuki (2184) and Honda (2300), and to be just 101 units behind Subaru (2454) – came as rival brands experienced supply shortfalls stemming from Japan’s March 11 earthquake and tsunami, company management is quick to point out that the Korean brand’s results are in accordance with its business plan and are being achieved despite its own serious supply problems. Global growth for Kia is continuing apace, with sales up 18.7 per cent year to date – including a 48.4 per cent rise in North America – after the corporation cracked more than two million sales in 2010 for an all-time high of 2,089,355 units, up 26.5 per cent on the previous year. Worldwide demand is outstripping supply and engineering resources are concentrating on major markets – all of which are left-hand drive – which means the factory-backed Australian subsidiary must trade with restricted volume and without certain overseas models that are not built for RHD, such as turbo-petrol engines for its Sportage compact SUV and Optima mid-size sedan, plus a hybrid for the latter.  From top: Kia Rio sedan, Picanto, Optima hybrid and Sorento diesel. From top: Kia Rio sedan, Picanto, Optima hybrid and Sorento diesel.Parent Hyundai Motor Co has also decreed that Kia operate as primarily a passenger car brand for the foreseeable future, meaning no access to versions of volume-selling light commercials such as the Hyundai iLoad. It still sells the K2900 light truck, but five years have passed without a replacement in sight for the Pregio van. Kia Motors Australia national public relations manager Kevin Hepworth told GoAuto this week that the company was working to achieve five per cent sales growth this year, which would take its volume past 25,000 for only the second time in Australia – from a high of 25,293 in 2005. Since then, sales hovered around the 20,000 mark until last year when Kia marched out of the economic downturn with 22.9 per cent growth (23,848 units) – its third-best result on record since it entered the Australian market in 1997. Year to date, sales are up 5.1 per cent – lineball with the overall market – but a five per cent increase for the entire year would still leave Kia about 5000 units short of the circa-30,000 total identified earlier this year by chief operating officer Tony Barlow, who said the company was working on “similar growth over 2010 this year”. The problem is, stocks of Kia’s big-selling small car – the Rio – have almost run dry and will not be replaced until the new-generation model starts rolling into showrooms late August or early September, after its mid-August media launch. Kia will launch the redesigned Rio in five-door hatch form and must wait until early next year to bolster the range with a sedan and three-door body styles. The new Picanto city car also should arrive here next year, although the business case, according to Mr Hepworth, “is still on the cooking pot”. “We’d like to think we were going to do at least five per cent more this year,” he told GoAuto. “Those numbers were set at the start of the year, and that’s the business plan we were working to – and we’re still working to – but the challenge is really Rio. “The run-out has been terrific – knowing that the on-ground stock is almost now gone – and we’ve just got to get the other car on the ground. “That car’s going to do very, very well for us, but there’s going to be a couple of lean months before then.” Mr Hepworth said Kia had no problem meeting demand for petrol model variants across its range, but diesel engines were in limited supply. “We are tight on diesel – we have more than we did three months ago – but we are still going to be tight for a while,” he said, adding that customer waiting times had contracted for high-demand models such as Sportage diesel, which at one stage was out past six months but is now back to between four and eight weeks. Based on the brand’s improved market acceptance and the increased demand for its new-generation vehicles, Kia Motors Australia believes that it would hold down a top-10 position if stock was not restrictions. “I don’t think anyone would argue with that,” Mr Hepworth said. “If we had unrestricted supply – which is not going to happen (in the short term) – I think at the moment there is enough demand and enough interest in Kia vehicles to certainly do that, particularly when Rio comes on line. “There is no risk that any car we land we can sell at the moment. People want the cars.” But can the Korean brand, which has grown from 5000 sales in 1998 to an expected 25,000 this year, become a permanent top-10 player in the longer-term? “I think we certainly deserve to be – all things being equal in the global market,” Mr Hepworth said. “You’ve got to understand that Kia globally is expanding at a huge rate, so naturally enough the big markets get first priority on a lot of things that are going on. “But that doesn’t mean we’re not in there chipping away, asking for everything we can get our hands on, and I would hope that we would stay around the top 10 on a long-term basis.” Mr Hepworth put Kia’s improved sales down to a combination of factors, including better styling (under the direction of former VW/Audi designer Peter Schreyer), five-year warranty, value-for-money status and a positive change in media perception about the brand. “The cars look good – nobody likes to drive an ugly car, people like people to say to them, ‘Oh, gee, that’s a good looking car you’re in’ – but I think it’s also to do with the amount of good press that the cars are getting ... media acceptance that suddenly these weren’t cheap and nasty cars but quite good vehicles,” he said. “Once that happens people read that, they see that, you get a few more out there, they tell their friends – ‘yeah I love this car, it’s going well’ – and it grows off that. “And the fact that the cars have a five-year warranty says we’re not afraid of the build, we’re confident that they’re good cars and they (customers) will be looked after. “And they (Kia models) are good value – they’re not expensive vehicles when you look at what you’re getting for your car.” Mr Hepworth suggested that Kia’s success also comes down, in part, to consumers turning to the brand when general economic conditions are poor – and liking what they find. “In a GFC situation, or even a bit of a tightening situation, people start to rationalise spending, and they start looking at value rather than just badge cred or what other people think of think of them (the brand),” he said. This line of argument says that once consumers realise they can get a particular model with a certain level of equipment for a better price than an equivalent competitors’ model, then the fact that it has a Kia badge can be easily rationalised. “Especially if it’s a car that’s getting good publicity, winning awards and my mates say to me, ‘Gee, that’s a good looking car.’” Other than Rio and the prospect of Picanto next year, there is not a lot of other action on the future model front for Kia, which in January launched its new-generation Optima and in recent weeks has revised its Carnival people-mover range – the headline act being the availability of the new 2.2-litre R-Series turbo-diesel engine first seen here late in 2009 in the Sorento mid-size SUV (and Hyundai’s Santa Fe). The company will continue to rely on its current range, which also runs to the Cerato range (including Koup), the Rondo mini-MPV and the Gen Y-oriented Soul small hatch. Following last month’s surge into the top 10, Mr Barlow said: “There is no doubt that, largely because of outside influences, it has been a very difficult month for some manufacturers, but Kia’s continued growth is due to the realisation and adherence to our long-term business plan. “Making the result even more satisfying is knowing that the nine manufacturers ahead of us this month all feature an extensive list of commercial vehicles in their line-up.” Of course, Kia would welcome access to new commercial vehicles, but there appears to be no prospect of that in the short-term. Mr Hepworth told GoAuto this week: “At the moment, there’s no global plan that I know of for a commercial arm to Kia. “It’s something that our product guys raise every chance they get – we’d love to have them back again – if we had have had Pregio numbers on top of what we’ve got now, we’d be having a great year. But that went away, unfortunately, and hasn’t come back. “What’s around the corner in 18 months, two years’ time, I don’t know. It’s certainly part of the business that’d be nice to get a handle into.”  Read more2nd of June 2011  New look for Kia dealersSydney dealer among the world’s first to adopt Kia’s new corporate look19th of April 2011  Shanghai show: Kia stages Rio sedan surpriseNext-generation Kia Rio sedan emerges ahead of expectations in China8th of March 2011  Geneva show: Kia designer keeps turning them outKia’s Schreyer says the sports car fun can wait until the Kia range is all ‘right’ |

Click to shareMarket Insight articlesResearch Market Insight Motor industry news |

Facebook Twitter Instagram