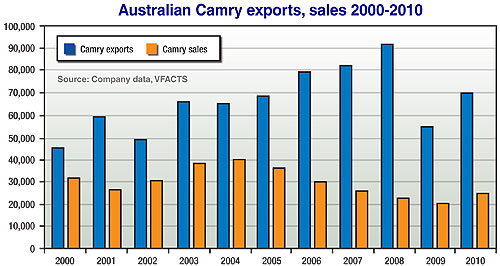

News - Market Insight - Market Insight 2011Market Insight: Crunch time for Toyota’s CamryHigh hopes: Toyota Australia is relying on the Altona-built, seventh-generation Camry (left) to win significant sales at home and abroad. Toyota Australia to rely heavily on Camry sales, production boost with all-new model30 Aug 2011 By TERRY MARTIN BY ANY measure, Camry has been a vital cog in the wheels of Australia’s car industry and a dominant figure on the Australian landscape. It has topped the medium-car segment in Australia for the past 17 years and is the country’s leading automotive export earner, routinely racking up more than $1 billion in annual export revenue during last decade as the vast majority of Camrys produced at its Altona plant west of Melbourne were shipped overseas to as many as 34 countries – mostly in the Middle East. The list of destinations is back to around 20 today, and while the Australian-built sedan remains the biggest-selling vehicle in the Middle East – still clogging the streets of Riyadh and Dubai as taxis, for example – demand has slowed in recent years as Camry exports fell from a record 92,000 units in 2008 to just 55,000 in 2009 (its worst result in seven years) before clawing back to around 70,000 units last year. The company, and all those who depend on it, are now relying heavily on the seventh-generation Camry unveiled last week to win back significant sales both here and abroad when the new model enters production in November. Severely impacted by supply shortages that followed the devastating March earthquake in Japan, and to also experience a production setback with the changeover to the new model, Toyota Australia now expects to build around 88,000 versions of Camry and the related Aurion this year (the redesigned Aurion V6 kicks off by April next year), with around 70 per cent heading offshore.  Left: New Australian Camry. Middle: Overseas shots of new V6 Camry (Aurion). Bottom: A current-generation Camry at the docks awaiting export. Left: New Australian Camry. Middle: Overseas shots of new V6 Camry (Aurion). Bottom: A current-generation Camry at the docks awaiting export.In Australia, the third-biggest market for Camry worldwide (behind the US and China), sales of the stalwart sedan are down 23.8 per cent so far this year, having improved 20 per cent last year (to 25,014 units) after a lean period during the economic downturn in which sales fell to 20,846 units in 2009 and 23,067 in 2008. Aurion, which replaced the unloved Avalon in 2006, is meant to account for at least as many sales as the Camry V6, but has also been on a steady downward slide, falling from 22,036 sales in its first full year (2007), to 19,562 in 2008, 13,910 in 2009 and to just 11,764 last year. This year, Aurion is down a further 28.6 per cent. Toyota is sticking with its Camry/Aurion strategy into the new generation, and while it has not announced sales forecasts for the new models, the company is aiming to return the Altona plant back to 100,000 units next year – the ceiling it broke through in 2008, when combined sales of 92,000 Camrys and 9500 Aurions saw it become the first Australian car manufacturer to crack 100K. Volatile global economic conditions and an export-crushing high Australian dollar will make Camry’s comeback a difficult task, but the goal is to move up to 120,000 units in the short term – and to head upstream from there. Tracking the history of the Australian-built Camry underscores how important a position in the Australian industry and economy – if not the psyche – the car now occupies. Australia became the first country outside Japan to build the Camry when it replaced Corona at Toyota’s Port Melbourne plant in 1987 and, although the Camry had export markets, it took until 1996 and a deal with the Middle East for Toyota to become Australia’s top automotive exporter with more than 14,000 shipments from its new Altona assembly plant (opened in 1994). Then, as is still the case, the Middle East accounted for more than 90 per cent of Toyota’s export business, with total Camry exports doubling within two years and then doubling again to pass 45,000 by 2000. Within another five years, that figure had grown to 69,000 in 2005, more than 79,000 in 2006, 82,500 in 2007 (with Aurion’s 12,500 taking Toyota close to 100,000 exports) before the 100K breakthrough a year later. Domestic sales growth was relatively steady, but nowhere near as productive as the export boom, with Camry sales in Australia rising from around 23,000 in 1995 to more than 38,000 in 1999, but then falling to the low-30Ks (and to as low as 26,693 in 2001) before heading northward to an all-time high of 40,356 in 2004 – the year in which Altona produced its one millionth Camry. Camry has never reached those heights again with Aurion now sharing the load, but combined sales topped 48,000 in Aurion’s first full year in 2007 before falling to below 43,000 a year later and to the mid-30Ks in 2009/10. There are, therefore, a lot of hopes pinned on the all-new model climbing out from the slump this year and returning Camry/Aurion back to the 50,000 mark that Toyota has proven the twin-model strategy is capable of achieving. That would ease some pressure on export growth or, more likely, provide Toyota with a boost that should send production past 120,000 units as it continues its quest for a third model line at Altona and fends off threats posed by the seven other plants also producing Camry (two in the US and one each in Japan, Thailand, China, Russia and Vietnam). As GoAuto reported exclusively in July, Toyota Australia is also working on a case to export Altona-built Camrys to Thailand, which could provide it with an additional 30,000 units a year. In April last year, Toyota produced its 1.5-millionth Australian-built Camry after 23 years on the job. From here on, Australian and regional demand – and therefore the rate at which Altona builds the forthcoming new model – now looks set to play a significant role in determining how far its future extends beyond two million units and seven generations.  Read more |

Click to shareMarket Insight articlesResearch Market Insight Motor industry news |

Facebook Twitter Instagram