Make / Model Search

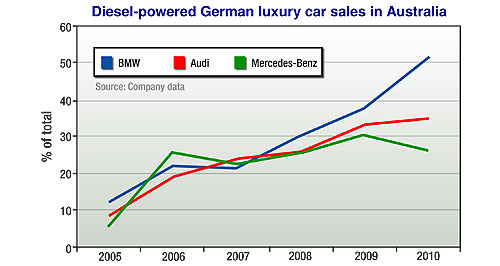

News - Market Insight - Market Insight 2011Luxury car buyers switch to diesel powerDiesel do: Luxury car buyers are increasingly opting for diesel power, like Audi’s V8 diesel A8 limo, which provides powerful performance without punishing the purchaser at the pumps. BMW, Audi reach record diesel sales in 201021 Feb 2011 ONE in three cars sold by the big three German luxury brands in Australia last year were diesel-powered, more than three times the overall market average of 12 per cent. Leading the charge was BMW, where diesel sales in 2010 outnumbered petrol for the first time, with a 52 per cent majority – up significantly from 38 per cent in 2009. Audi’s diesel sales continued to grow, the proportion of Ingolstadt oil-burners sold here rising to a record 35 per cent in 2010, while Mercedes-Benz, for which sales of diesel passenger cars have fluctuated since 2006, saw the proportion of diesels sold drop from 30 per cent in 2009 to 26 per cent last year. While the sole selling point of diesel engines used to be fuel economy – until recently they were inferior to petrol engines in almost every other way – spokespeople for all three brands in Australia agreed it is the power delivery of their modern diesel engines that appeals to their customers. “Customers are continually amazed at the performance levels on tap,” said BMW Australia head of corporate communications Piers Scott. Mercedes-Benz Australia Pacific senior manager for corporate communications David McCarthy said: “Diesel sales will only increase thanks to the fact that these engines now more than rival petrol engines in terms of power and offer a lot more torque. Buyers love the technology, they love the torque.” Although popular opinion would suggest that saving money is unlikely to be on the mind of your average luxury car buyer, Mr McCarthy said the luxury car tax exemption up to $75,375 for vehicles consuming less than 7.0L/100km was a big draw, and that among customers it was seen “as a badge of honour to be paying less LCT”.  From top: TDI versions of the Audi A8, Mercedes S-Class and BMW X5. From top: TDI versions of the Audi A8, Mercedes S-Class and BMW X5.Although everybody enjoys paying up to $5000 less tax and saving money on fill-ups, customers also benefit from the feel-good factors associated with using less of a finite resource and emitting fewer CO2 emissions than they would driving a petrol-engined equivalent. In addition, Mr McCarthy said diesel drivers are enjoying added significant convenience of having a large tank range, “which means the difference between filling up every 10 days with a petrol compared with every 15 or 18 days when you drive a diesel”. Given that one-third of all SUVs sold in Australia last year were diesel-powered, it is not surprising that BMW is the luxury diesel leader, with SUVs making up more than 34 per cent of its 2010 sales, against Audi’s 27 per cent and Mercedes’ 13 per cent. Mercedes SUV sales figures show a steady rise in the proportion of off-roaders powered by diesel, from 31 per cent in 2005 to 74 per cent last year. Mr McCarthy said V8 and AMG versions will always have their own market and that, so far, orders of diesel G350 and petrol V8 G55 variants of the new G-wagen have been split 50:50. Until relatively recently, diesel engines were perceived as dirty, smelly, noisy, sluggish and unrefined. The only reason for choosing a diesel-engined car was the huge difference in fuel economy, which saved money at the pumps. In Australia, diesel was the preserve of agriculture, haulage and eccentrics. The diesel pump was hidden shamefully around the back of many petrol stations and, if you wanted to save money on fuel, you would instead have your vehicle converted to run on LPG. This is still the case with locally-built Falcons and Commodores, although the revised Territory SUV finally goes on sale in May with a diesel option. So what has caused the turnaround? Audi Australia product planning general manager John Roberts told GoAuto at the recent A8 TDI launch that improved fuel quality is a factor. “The local fuel wasn’t up to it until recently because of the very high sulphur content,” he said. “We couldn’t bring the engines out here until they reduced the sulphur and now it’s really good. “Audi’s first diesel engine in Australia was with the Allroad in 2002 and it remained the only one until 2004 so in just six years we’ve gone from almost zero to reach 35 per cent.” Vices traditionally attributed to diesel engines, including poor refinement and a clattery soundtrack, are also being eliminated. Mr Scott from BMW Australia said of its customers: “A consistent response is that these engines don’t sound as you would expect. Many say you would barely know it’s a diesel”. Audi agrees, with Mr Roberts predicting that “the proportion of Audis sold with a diesel engine will increase as refinement is getting better all the time – people love the three-litre TDI engine”. Another convincing factor for diesel cynics is the success that Peugeot and Audi have enjoyed at the famous Le Mans 24 Hour race using diesel technology. Audi Australia product manager Jacqueline Walden said: “Audi is noted for its racetrack winning streak powered by TDI. It really does prove our TDI know-how and the technology not only benefits us on the racetrack, it benefits our customers.” While Mercedes was the only German luxury car manufacturer to see a decline in diesel sales last year, Mr McCarthy put this down to restricted supplies of the 2.1-litre CDI engine early in 2010 and the fact that efficient new turbocharged petrol CGI engines resulted in more C-class and E-class customers opting for petrol power. Mercedes this week launched the S350 BlueTec limo in Australia, which not only offers sub-7.0L/100km fuel economy but is also the first locally-available diesel car that complies with Euro 6 emissions (due to come into force in Europe in 2014). BMW and Audi currently have no Euro 6 diesels in the pipeline. The highly taxed market in Europe has been a driving force behind diesel development. In the 1990s, traditionally low taxation on diesel fuel began to rise, reducing the difference in cost against petrol. The ever-increasing efficiency of petrol engines further closed the gap, extending the number of kilometres the extra investment in a diesel model took to recoup. Turbocharging has long been used to boost the power of diesel engines but in 1997 common rail direct injection – using high-pressure, electronically-controlled fuel injectors – made its passenger car debut in the Alfa Romeo 156 and Mercedes-Benz C-class. It was a big step forward in power, torque and refinement for diesel engines and Volkswagen Group did a lot to popularise the technology, going so far as to produce a “hot” Mk3 Golf GTD, which equalled the torque output of its 2.8-litre VR6 flagship. The diesel movement quickly gathered momentum when European governments started reacting to climate change by taxing vehicles according to their CO2 output. As diesels produce less CO2 than their petrol equivalents, fleets and private buyers took advantage of the tax breaks. As the saying goes, competition improves the breed and, as car companies fought for the diesel dollar while striving to satisfy increasingly stringent European emissions regulations, their investment resulted in extra power and more refinement. In BMW Australia’s case, diesel’s role as an alternative fuel has been reversed – now petrol engines have become the alternative. “BMW’s free-revving petrol engines will retain their distinct appeal,” said Mr Scott. “However, there is more to come with regards to diesel, including a three-cylinder diesel engine. Watch this space.”  Read more |

Click to shareMarket Insight articlesResearch Market Insight Motor industry news |

Facebook Twitter Instagram