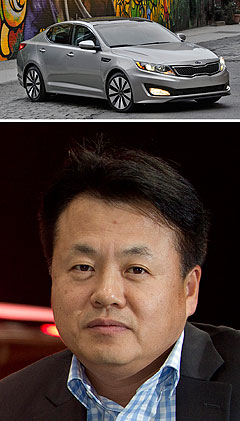

News - KiaKia has Hyundai in crosshairsOn the way: Kia's model line-up will be expanded later this year with the arrival of the hatch version of its Cerato small car. Blood is no thicker than water as Kia chases Hyundai with big sales aspirations9 Aug 2010 KIA Motors Australia (KMAu) is aiming to increase sales by 50 per cent to 30,000 units over the next 18 months to become a top 10 player in this country, with the long-term target of outgunning in-house rival Hyundai. Driving the volume will be a complete overhaul of the South Korean company’s offerings in Australia’s biggest vehicle sales segments. This will include a hatch version of the Cerato small car and a rival for the Toyota Camry in 2010, a totally revamped Rio light car during 2011 and an all-new Cerato series by the end of 2012. The bestselling people mover, the Carnival, will also be redesigned for a 2013 release in Australia. Kia promises that all will undergo suspension and steering tuning that better suits Australian road conditions, in the same manner that the all-new (and all-important) SL-series Sportage compact SUV (released earlier this month) has trailblazed for KMAu. The new-model avalanche will build on the momentum that commenced in 2009 on the back of the second-generation TD Cerato sedan and its Koup sibling, youth-orientated Soul wagon and XM Sorento mid-sized SUV.  Left: Kia Optima. Below: Kia Australia president and CEO MK Kim. Left: Kia Optima. Below: Kia Australia president and CEO MK Kim.Kia’s local aspirations were revealed to GoAuto at the SL Sportage’s Australian launch in New Zealand earlier this month by KMAu president and CEO, MK Kim. He also emphasised Kia’s aim to reach the 30,000 sales level by the end of next year. That’s a 10,000 unit rise from the 19,407 tally achieved in 2009 (which was 1.3 per cent down on the previous year, while the goal for 2010 is for the firm to find 25,000 buyers. But that is still a long way off from the 63,207 vehicles Hyundai Motor Company Australia (HMCA) shifted last year, representing a 40 per cent leap from 2008’s 45,409 total. Year to date, Kia sales are up 2829 on the same period of 2009 (14,264 versus 11,435), while a hard-charging HMCA is enjoying a record year with another near-40 per cent boost in volume, to 48,902 (versus 36,161 in 2009). The Kia Soul, Cerato sedan, XM Sorento and K2900 truck are all up about 35 to 40 per cent, while keen deals on the outgoing KM Sportage has it up by almost 60 per cent year-on-year. According to Mr Kim, Kia expects to reach 25,000 sales in 2010 by filling in key gaps in its product portfolio. During the last few months the old Sportage was averaging around 220 sales but the new SL is forecast to find 300 homes each month. From October, the long-awaited and somewhat overdue Cerato hatch will give Kia access to more than half of the small-car market that has been denied to it as a result of having a sedan-only offering since the beginning of 2009. It puts paid to speculation that KMAu would eventually import the Slovakian-built Ceed to fill the gap left by the old Cerato hatch. Introduced abroad during 2006, cost pressures have long kept the Ceed from Australia, including its sophisticated chassis (featuring an expensive, Ford Focus-style multi-link rear suspension design), and complicated transportation issues from the factory. European demand outstripping supply hasn’t helped either. “This Cerato hatch is very important for us,” Mr Kim said. “In Australia 55 per cent of all small car sales are hatches.” The TD Cerato hatch was styled at the Kia Design Centre in America, and was unveiled at the New York International Auto Show in April. That show also served as the world premiere of the TF Optima, Kia’s belated replacement for the unloved MG-series Magentis midsizer that was discontinued in Australia just on two years ago. Despite its poor performance in the Camry sector, KMAu’s hopes for the coming Optima have been buoyed by the unprecedented success of the new model in South Korea. “Already the Optima is outselling the i45 in the Korean domestic market. Overall sales over the last three months are higher (than Hyundai’s),” Mr Kim said. “This is the first time ever … and this is because of the Optima’s design and I would like to say, quality.” Mr Kim admits that it will be a difficult task to sway Australian midsized buyers away from the established marques, but believes that getting a foot in the door with the right product is the key to winning over new business. “I think the medium market is very difficult to get into because of the Toyota Camry,” he said. “But we have to knock on the door (of buyers) – and it’s been the same in Korea too (against the long-time sales champion Sonata/i45). “A marathon starts with the first step and without that first step you cannot finish the race.” Meanwhile, 2011 will see the next piece in the Kia new-model puzzle with the long-awaited replacement for the JB Rio. Dubbed UB (though some media outlets are saying ‘LB’) and styled by new Sportage designer Massimo Fraschella in California, the third-generation light car will once again be available in four-door sedan and five-door hatch guises. The next Rio is expected to employ a heavily modified version of the MC platform that underpins the current car as well as Hyundai’s now discontinued for Australia MC Accent. Speaking of Hyundai, its newly unveiled replacement for the HD Elantra, the MD Avante (will it be called i35 in Australia when it is launched next year?) is rumoured to be the basis for the next-generation Cerato. Dubbed the YD, it will complete former Audi designer Peter Schreyer’s makeover of the Kia passenger car range when it debuts in Australia during the latter part of 2012, and will introduce smaller forced-induction petrol engines like the 1.6-litre turbo unit found in some overseas Hyundai models, as well as six-speed transaxles in the company’s small-car fleet. That will be followed in 2013 by the third-generation Carnival people-mover, replacing the VQ series that has been with us since early 2006. According to one Kia insider, the next Carnival will be lighter and lower than the existing range, and will be slightly more ‘wagon-like’ in silhouette. The front-wheel drive platform is believed to be based on the i45/Optima item. Despite the fact that they are part of the same conglomerate, Kia sees Hyundai as a mortal enemy in the global marketplace, so Mr Kim will not concede an inch to HMCA in Australia. “In Australia, I would like to sell more than Hyundai,” he said.

Read more |

Click to shareKia articlesResearch Kia Motor industry news |

||||||||||||

Facebook Twitter Instagram